Scope

The scope of this Practice Note is solely to ensure a consistent valuation approach for this Property Class/Sub Class/Type for Non-Domestic Revaluation 2023 and subsequent entry in the new Valuation List which becomes effective on 1 April 2023.

The basis of valuation for new entries in the Valuation List, and Rating Revision cases after 1 April 2023, is Schedule 12 (2)(1) of the Rates (NI) Order 1977.

Description

This Practice Note refers to property classified as:

Class: Filling Stations

Sub Class: Filling Station, Supermarket Filling Station, Unmanned Filling Station

Type: N/A

Legislative background

Schedule 12 Part 1 Paragraph 1 of the Rates (NI) Order 1977 applies.

“Subject to the provisions of this Schedule, for the purposes of this Order the net annual value of a hereditament shall be the rent for which, one year with another, the hereditament might, in its actual state, be reasonably expected to let from year to year, the probable average annual costs of repairs, insurance and other expenses (if any) necessary to maintain the hereditament in its actual state, and all rates, taxes or public charges (if any), being paid by the tenant”.

The primary legislation for filling stations wishing to be licensed to dispense motor spirit are the Petroleum (Consolidation) Acts (Northern Ireland) 1929 and 1937, the Health and Safety at Work (Northern Ireland) Order 1978 and the Dangerous Substances and Explosive Atmospheres Regulations (Northern Ireland) 2003 inter alia, governs the manner in which the daily activity is conducted. There is additional legislation and regulation which relate to housekeeping, product handling, construction, development and alterations but this is not directly associated with the NAV assessment and so is not cited here.

Valuation approach for 2023

A hybrid approach, the shorthand R&E method for the Petrol Forecourt and the Comparative method for the Forecourt Shop and Non-Forecourt buildings is to be retained as the approach for this type of hereditament.

The methodology set out below retains the established segmentation of the assessment into the four primary valuation elements, i.e., Forecourt, Forecourt Shop, Car Wash and Non-Forecourt Buildings.

Forecourt

The methodology set out below will apply across the whole of Northern Ireland and for the purposes of volume related assessment, all grades (e.g. Super Unleaded) and fuel types (Petrol, Diesel, Red Diesel and occasionally Kerosine) should be aggregated. The established concept of Maintainable Throughput will be retained and will be generally defined as the volume of fuel which might reasonably be expected to be achieved by a hypothetical tenant operating competitively, in terms of both pricing and opening hours, with comparable sites in the locality. The Maintainable Throughput may be derived by adjusting the Actual Throughput to account for variations in pricing and opening hours.

No adjustment should be made in respect of fuel paid for by credit cards or sold on account.

There are three elements to the forecourt assessment:

1. The extent of the Developed Forecourt Layout.

2. The portion of Maintainable Throughput in excess of the relevant Zero Rate Thresholds (excluding all fuel dispensed through the forecourt under any Agency/ Bunkering arrangement).

3. Agency/ Bunkered fuel.

Element (1) – Developed Forecourt Layout

Establish the number of filling positions which can be used concurrently, each assessed at £300 per concurrent filling position (£150 if forecourt has no canopy). See Appendix 1 for the potential layouts.

Red Diesel and Kerosine pumps are excluded in the calculation of concurrent filling positions.

Element (2) – Maintainable Throughput in excess of Zero Rate Threshold

This element relates to the volume of throughput and the normal starting point should be the Actual Fuel Throughput. Where Actual Throughput Figures are not available then comparisons should be made with other similar sites with similar facilities in the locality to determine the hypothetical achievable throughput.

The weighted mean selling price as at 1st October 2021 is 136.9ppl.

In order to arrive at the Maintainable Throughput NAV you must consider and apply where applicable the following 5 steps;

1. Deduct all Agency/ Bunkering throughput.

2. Multiply the Actual Volume (Net of agency/bunkering) by the appropriate factor in Table 1.

Table 1

Factors applied for differential between weighted mean selling price (WMSP) and pole sign price

| If pole-sign price at AVD is | Pence per litre differential from WMSP | Apply factor | AO pricing drop down selection |

| within | 2.0 ppl | 1 | Between, or equal to, Plus or Minus 2ppl |

| more than | 2.0 ppl higher | 1.1 | More than 2ppl and less than or equal to 4ppl ABOVE average |

| (but less than or equal to 4.0 ppl) | |||

| 4.0 ppl higher | 1.2 | More than 4ppl ABOVE average | |

| more than | 2.0 ppl lower | 0.9 | More than 2ppl and less than or equal to 4ppl BELOW average |

| (but less than or equal to 4.0 ppl) | |||

| 4.0 ppl lower | 0.8 | More than 4ppl BELOW average |

** Weighted mean selling price as at 1st October 2021 (AVD) is 136.9ppl.

3. The predominant opening hours for the majority of Filling Stations are 108 to 112 hours per week but where a filling station is open to dispense fuel for more than 130 hours per week, then the volume resultant from step (2) above should be further reduced by applying a factor of 0.9. No adjustment for opening hours should be made to unmanned 24hr filling stations.

4. Deduct 2.4 million litres (or 1.2 million litres if the site is unmanned) to determine the maintainable throughput.

5. Having calculated the Maintainable Throughput you must then consider the rate per £1,000 litres applied to any volume exceeding the Zero Rate Threshold, which for Unmanned sites is 1.2 million litres and Manned sites is 2.4 million litres.

Table 2

Rate per £1,000 litres applied to volume of maintainable throughput exceeding zero rate threshold throughput type/ volume maintainable throughput rate

| Throughput type / volume | Maintainable throughput rate |

| Unmanned site up to 1.2m litres | Nil |

| Unmanned site over 1.2m litres | £14 per 1,000 litres |

| Manned site up to 2.4m litres | Nil |

| Manned site 2.4m – 3.4m litres | £10 per 1,000 litres |

| Manned site over 3.4m litres | £10 per 1,000 litres applied to litres between 2.4m – 3.4m, PLUS £14 per 1,000 litres over 3.4m. |

Element (3) – Agency and Bunkering

This element of the forecourt assessment relates to the fuel volume, dispensed from the filling station, on an Agency/Bunkered basis, that is, fuel held or available at this location, but paid for to a third party. This arrangement is frequently used by hauliers and drivers of company vehicles and, for diesel, could involve the use of an above ground tank and a high speed pump completely divorced from the forecourt. For each litre dispensed, the operator receives a handling fee only. The contribution to NAV should be assessed at the rate of 0.3 ppl or £3.00 per thousand litres.

The Forecourt contribution to the Filling Station NAV is the aggregation of Elements 1, 2 and 3, where applicable.

Forecourt Shop

The hypothetical shop rental for filling stations shall be determined using the comparative method of valuation.

Vacant and to let the following forecourt shop type bands may be envisaged;

1. Kiosks with filling stations.

2. Shops with filling stations.

3. Service filling station shops.

It must be determined which band above a filling station shop fits into before any assessment of the hypothetical shop rental.

Kiosk type shops (Band 1) are often associated with Supermarket Filling Stations however they may be found among smaller branded operators and in more secondary and rural locations.

Shops with filling stations (Band 2) should be valued in line with the Neighbourhood Shop Practice Note.

Service filling station shops (Band 3) are located on main arterial routes, where in addition to the petrol filling station shop, there are multiple services available. These may include a combination of seating areas, toilets and baby changing facilities, play area, cafes, food outlets, off license. This list is non-exhaustive and additional services may vary from shop to shop.

Service filling station shops are not comparable to Neighbourhood Shops as they are not in the same state and circumstances. They should therefore be valued in their own grouping, on a comparable basis, having regard to similar types in the Valuation List.

Unmanned filling stations fall into two groups, (1) where the site was purpose-built as an unmanned filling station and (2) where the site was previously occupied by a tenant or licensee and where the owner has screened off the former shop and now operates the existing forecourt on an unmanned basis. Where (2) applies and the former shop building remains structurally unchanged and has simply been screened off then the former shop building should be valued in line with similar stores in the vicinity. The throughput element is valued as per the unmanned station threshold.

Car Wash

If a car wash is on an unscreened open concrete pad with proper drainage, whether Lance or Rollover then it should be valued at £1,200. Where a car wash is located behind a screen or housed in a building then it should be valued at £1,600.

The approach above applies only to Filling Station car washes. All standalone car wash facilities are valued under a separate practice note.

Non-Forecourt Buildings

Buildings/structures other than the forecourt, forecourt shop and carwash, should be valued in line with similar bulk class properties in the locality, adjusting for access, construction quality and parking where appropriate.

Electric Car Charging Points

Electric car charging points located on forecourts should be referenced but no value will be attributed to their presence as part of the forecourt assessment.

ATMs

For valuation of ATMs on site these are valued under a separate practice note.

Rent and Lease Questionnaires

For this class of property RALQs were issued centrally by LPS.

Contacts

For advice on any aspect of this Practice Note contact LPS on 0300 200 7801.

Regulating body

The government require those who store and supply fuel to have a petroleum licence. Your petroleum licence will state who it has been issued to, how long it is valid for and any other conditions an individual must meet to safely store and dispense petrol on their site. The Petroleum Storage Licence (Northern Ireland) is regulated by each individual district council.

- https://www.gov.uk/petroleum-storage-licence-northern-ireland

Antrim & Newtownabbey

- https://antrimandnewtownabbey.gov.uk/business/environmental-health/business-licensing-registration/business-licensing/petroleum-licence/

Ards & North Down Borough Council

- https://www.ardsandnorthdown.gov.uk/apply

Armagh, Banbridge & Craigavon Borough Council

- https://www.armaghbanbridgecraigavon.gov.uk/business/licensing/#1488467397635-14970e40-9b24

Belfast City Council

- https://www.belfastcity.gov.uk/planning-and-building-control/licences-and-permits/petroleum-licence

Causeway Coast & Glens Borough Council

- https://www.causewaycoastandglens.gov.uk/live/health-and-built-environment/licensing/petroleum

Derry City & Strabane District Council

- https://www.derrystrabane.com/Licensing/Petroleum-Licence

Fermanagh & Omagh District Council

- https://www.fermanaghomagh.com/services/licensing/petroleum-storage/

Lisburn & Castlereagh City Council

- https://www.lisburncastlereagh.gov.uk/forms/payments/petroleum_licence_application

Mid & East Antrim Borough Council

- https://www.midandeastantrim.gov.uk/resident/environmental-health/environmental-health-fees

Mid Ulster District Council

- https://www.midulstercouncil.org/online-services/petroleum-licence

Newry Mourne & Down District Council

- https://www.newrymournedown.org/petroleum-licensing

Trade body/ association

Petrol Retailers Association (PRA)

201 Great Portland Street

London

W1W 5AB

Tel: 020 7580 9122

https://www.ukpra.co.uk/

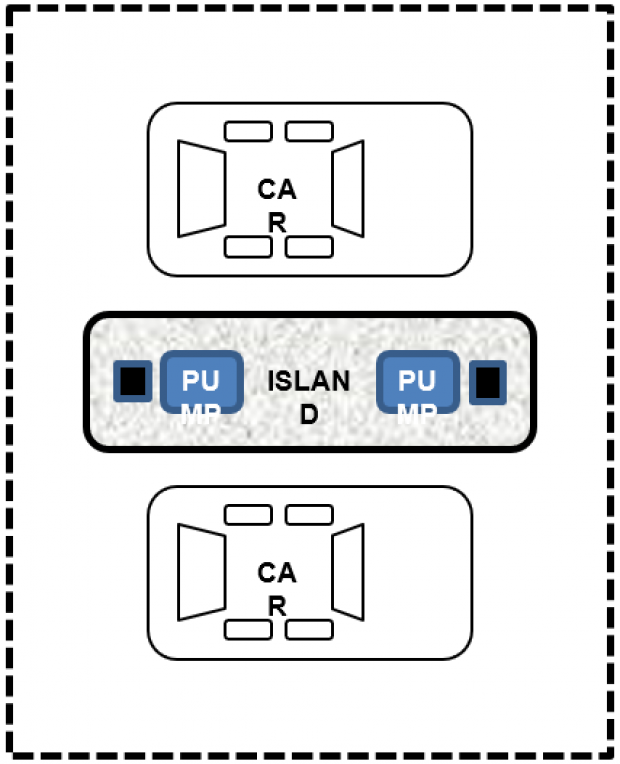

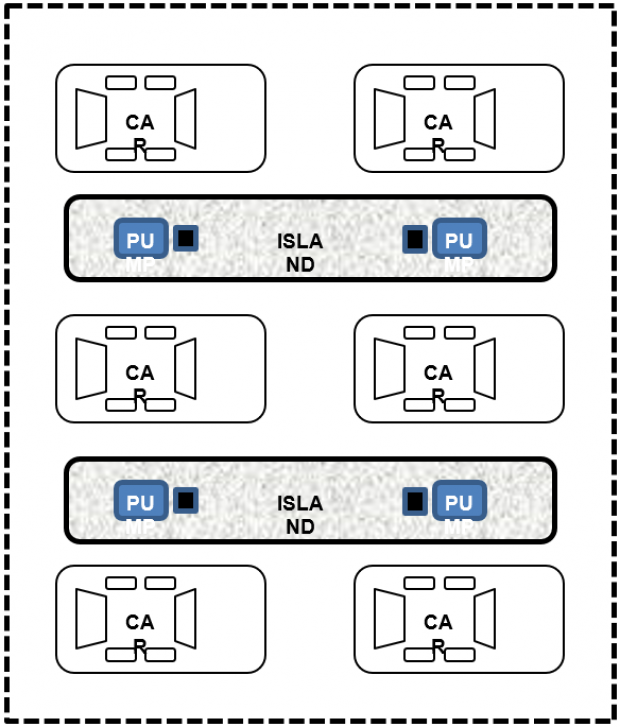

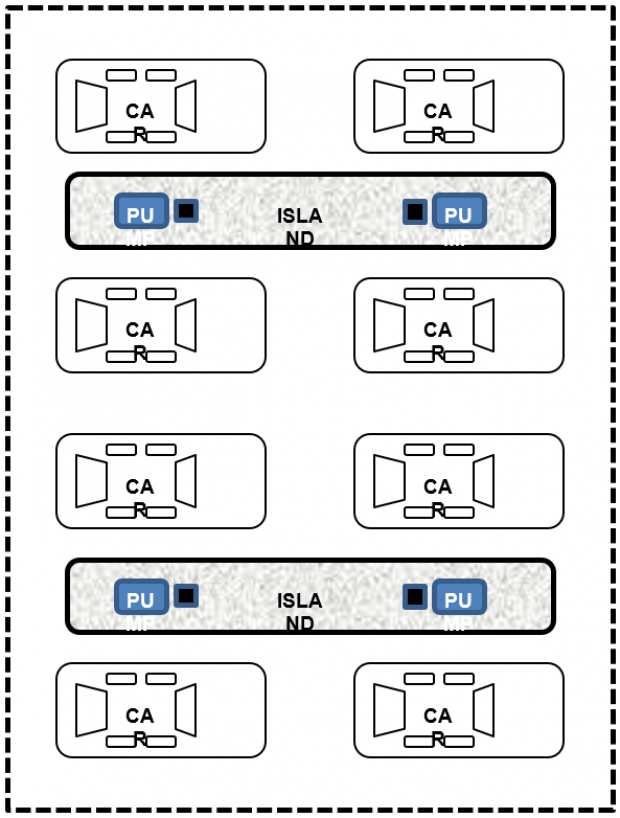

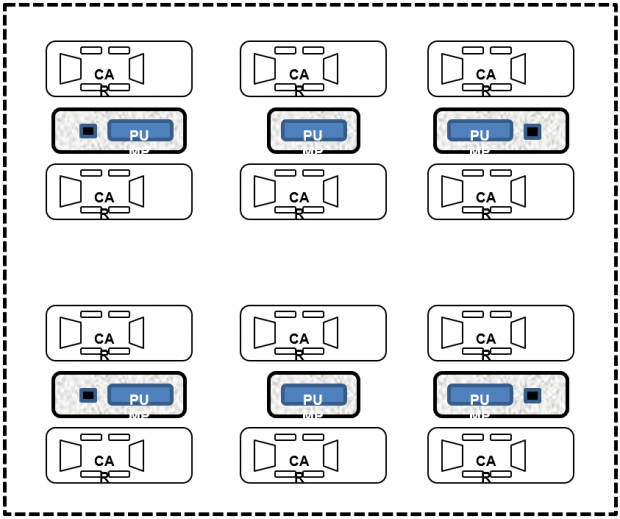

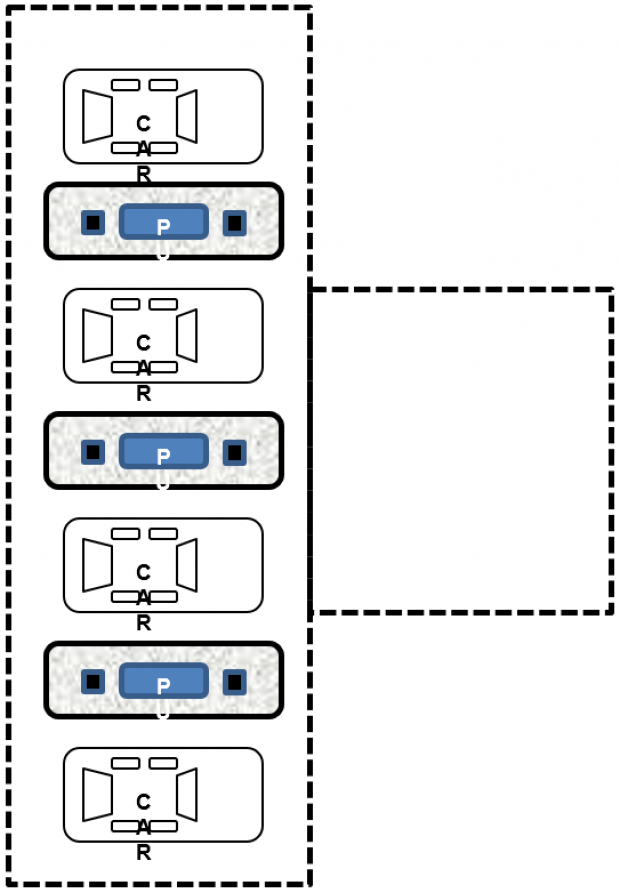

Appendix 1: Developed forecourt layout

The following sketches should cover the majority of layouts, all of which are assumed to have a canopy. If the site has no canopy, multiply the count of concurrent filling positions by £150.

Assessed development worth:

- 2 Concurrent Filling Positions X £300 = £600.

Assessed development worth:

- 6 Concurrent Filling Positions X £300 = £1,800.

Assessed development worth:

- 8 Concurrent Filling Positions X £300 = £2,400.

Assessed development worth:

- 12 Concurrent Filling Positions X £300 = £3,600.

Assessed development worth:

- 4 Concurrent Filling Positions X £300 = £1,200.

Appendix 2: LPS definitions

Agency (or Low Margin Fuel Cards)

A contract exists between fuel company and card holders, card company effectively repurchases the fuel from the forecourt operator at cost price and forecourt operator receives a handling fee for dispensing the fuel.”

Bunkered Fuel

Bunkered fuel is fuel which is stored and dispensed by a forecourt operator generally on behalf of another company, for which the operator receives a handling fee.

Zero Rate Threshold (Breakeven Point)

The Zero Rate Threshold establishes the volume of forecourt throughput at which the operator’s income from fuel sales covers the minimum running costs of achieving such whilst open for 110 hours per week. In simple terms this is the total forecourt throughput necessary to achieve breakeven. For unmanned sites the threshold is 1.2 million litres and for manned sites the threshold is 2.4 million litres.

Unmanned Site

Are unstaffed fuel pumps which allow public access to fuel via card payment over longer operating hours e.g. 24/7. They can be purpose built sites or former manned sites converted for purpose.

Manned Site

Are staffed fuel pumps which allow public access to fuel via cashier payment (or card payment at pump) usually during designated hours. They generally incorporate a retail shop selling convenience goods but not always. Note some sites operate for longer than the standard 110 hours per week and can have night pay windows (in order to close the shop if applicable) or to allow operation with minimum staff.

Actual Throughput

Is the Actual Throughput in litres per annum provided by the subject site.

Hypothetical Achievable Throughput

Where Actual Throughput figures are not available then comparisons must be made of the subject site with other similar sites with similar facilities in the locality. The valuer will make a judgement on the Hypothetical Throughput in litres per annum.

Maintainable Throughput

Maintainable throughput is expressed in litres per annum and is derived by adjusting the Actual Throughput to account for variations in pricing and opening hours.

The Weighted Mean Selling Price

This is the average price of the sum of both petrol and diesel figures in Northern Ireland taken at the AVD date. For Reval 2023 the Weighted Mean Selling Price is 136.9 pence per litre.

Pole Sign Price

For purpose of this Practice Note this is the price of both petrol and diesel displayed at the forecourt site on the AVD date.

Maintainable Throughput Rate

This is the rate per thousand litres applied to the volume of maintainable throughput exceeding the Zero Rate Threshold. The rate varies depending on type of site e.g. manned or unmanned and also depending on the volume of litres over and above the threshold.